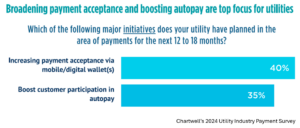

Mobile Wallets and Autopay Lead Utility Payment Initiatives

By Stacey Bailey

Mobile wallet and autopay enrollment are critical strategies for the industry as utilities seek to meet increasing customer expectations and also improve revenue stability in the wake of increasing arrearages across the industry.

👉 Discover 7 initiatives topping the charts

Autopay, in particular, helps utilities reduce delinquencies and payment volatility by ensuring bills are paid on time each month.

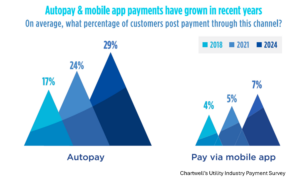

Autopay enrollment is widely available, but not growing as quickly as utilities would like, with only a 12-percentage point increase in the 6-year period from 2018 to 2024.

Utilities are promoting autopay through bill inserts, email and SMS campaigns, enrollment incentives, and simplified sign-up flows within online portals. Some are pairing autopay with budget billing or alerts to help customers feel more in control of their finances, easing concerns about unexpected charges.

👉 Reveal 6 challenges that keep your peers up at night

Mobile pay options—such as utility apps, digital wallets, and text-to-pay—are gaining traction in the utility industry as customers increasingly expect to be able to manage their lives on their phones. Utilities are investing in intuitive app design, real-time balance visibility, and secure payment integrations to meet the expectations of younger and digitally savvy customers.

For utilities, the payoff goes beyond convenience. Increased use of autopay and mobile pay can lower operating costs, improve cash flow predictability, and strengthen customer satisfaction—making digital payments a key component of utility strategy.

Read about the Billing and Payment Leadership Council.

You may also like these blog posts:

- Balancing Write-Off Strategies: Helping Customers While Protecting the Bottom Line

- Arrearage Burdens: A Growing Challenge for Utilities and Customers

- New Research Published: Chartwell’s 2024 Payment Survey Benchmarks

Insight Center Utility Customer Research:

- Consumer Trends 2025: Utility Leaders Tasked With Strategically Addressing Affordability

- Utilities Share Their Payment Initiatives and Challenges For The Road Ahead

- Chartwell 2024 Payment Survey Datasheet