Balancing Write-Off Strategies: Helping Customers While Protecting the Bottom Line

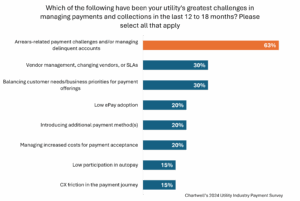

In Chartwell’s recent Utility Industry Payment Survey, utilities identified Arrears Management as the top challenge in managing payments and collections. Write-off strategies are a key component in managing this challenge. In a recent Chartwell webinar, industry leaders gathered to discuss the complex balancing act of utility write-off strategies, exploring how finance and operations teams collaborate to improve outcomes while meeting financial, operational, and customer satisfaction objectives.

👉 Watch the free webinar on demand! Balancing the Write-Off Strategy — Finance & Operations

The Write-Off Process: A Strategic Timeline

Sam Faye of Manitoba Hydro outlined a detailed timeline for managing customer arrears. The process begins with proactive outreach—using notices, texts, and even physical disconnections—to encourage payment. When a customer goes inactive, Manitoba Hydro initiates a 90-day period of intensified collection efforts before transferring the debt to a third-party agency. Only after a year does the debt officially get written off. This approach underscores the importance of exhausting all avenues before accepting a loss.

Vida Hotchkiss, drawing on decades of experience at Nicor Gas, emphasized that most utilities share similar processes, with a strong focus on collecting from active customers and leveraging government assistance where possible. The timing of write-offs can significantly impact corporate financials, especially during economic disruptions like COVID-19.

👉 Check this out on the blog: New Research Published: Chartwell’s 2024 Payment Survey Benchmarks

Collaboration and Communication: Breaking Down Silos

Both panelists highlighted the evolution of internal collaboration. What began as isolated monthly reporting has shifted to regular, cross-functional meetings involving finance, operations, and customer service. This increased frequency—especially during crises—ensures that all stakeholders are aligned and responsive to changing conditions.

Sam described how Manitoba Hydro now holds weekly strategy sessions and monthly operational meetings, bringing finance into the loop every few months. This transparency helps prevent surprises and resistance, fostering a culture of shared accountability.

👉 Help shape the future of utility billing! You’re invited to participate in Chartwell’s 2026 Utility Industry Billing Survey. Contact us here to get started.

Empathy, Affordability, and Innovation

A recurring theme was empathy—recognizing that customers in arrears are often facing difficult circumstances. Utilities are investing in personalized outreach and leveraging technology, such as AI-driven risk models, to identify at-risk customers early and offer targeted assistance.

Panelists also stressed the importance of external partnerships and regulatory flexibility, especially in supporting vulnerable customers through programs like LIHEAP and “Neighbors Helping Neighbors.” The pandemic accelerated innovation, forcing utilities to adapt quickly and collaborate with regulators to better serve their communities.

Ultimately, success in write-off management is measured not just by financial metrics, but by trends in customer outcomes and the ability to maintain stability during turbulent times.

Learn more about the Billing and Payment Leadership Council by contacting Tim Herrick.

You may also like these blog posts:

- Breaking Barriers in Utility Billing Through Automation and Affordability

- Executive Issue Paper No. 09 – Energy Affordability in a Changing Policy Landscape

- Proactive, Personalized, Powerful: Con Edison’s Arrearage Emails Drive Engagement

Insight Center Utility Customer Research: