Chartwell Debuts 2025 Consumer Perspectives on Utility Service and Customer Experience

By Casey Collins, Senior Research Analyst

At the EMACS Conference held in October, Chartwell analysts unveiled their initial findings from Chartwell’s 2025 Residential Consumer Survey. Building upon these results, Chartwell has published its Premiere Report: Customer Views of the Utility in 2025, available now for Insight Center members.

The Premiere Report expands upon concepts highlighted at EMACS; specifically, the five core expectations that residential customers have of their utilities in 2025 and in the future:

- Affordability;

- Reliability;

- Sustainability;

- Transparency; and,

- Value-added services.

Customer concern about affordability – from their utility bills to expenses across the board – is well-documented, and Chartwell’s data shows affordability as the top-most issue in consumers’ minds. Lower-income households, defined as households with annual incomes below $50,000, more frequently exhibit signs of financial distress tied to utility bill payment; however, consumers at all income levels can – and sometimes do – find themselves at risk of late or nonpayment. And because financial vulnerability can be a short- or long-term crisis, consumers are eager to see their utilities provide greater assistance to customers in need. Nearly 70% of consumers surveyed indicated that their utility was not doing enough to help less fortunate customers pay their bills.

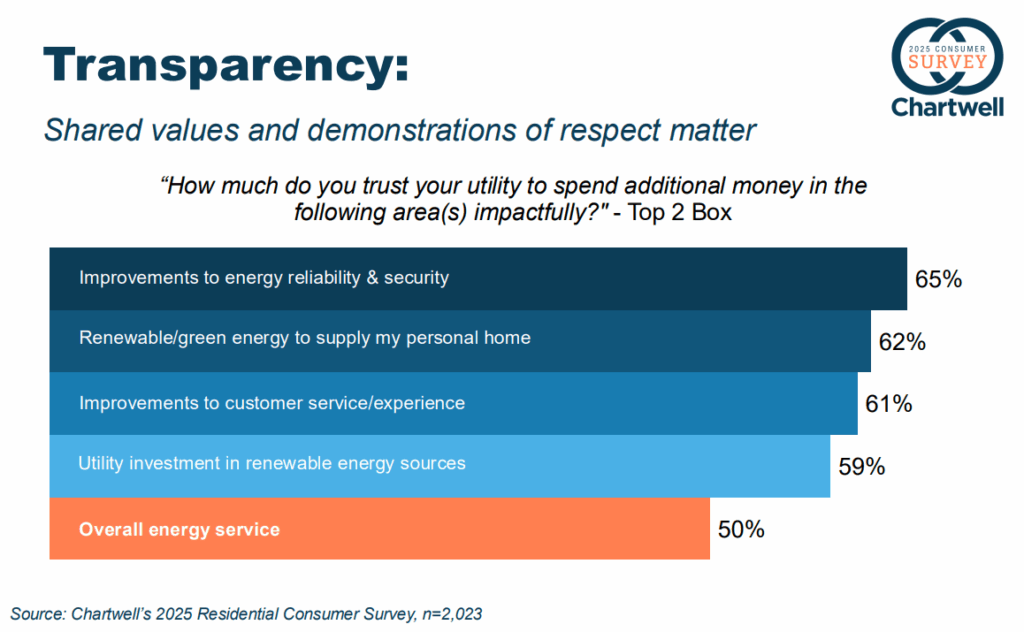

Utilities, of course, must manage competing priorities as they work to make service more reliable by investing in grid modernization and hardening, while also keeping utility bills affordable for customers who will ultimately cover the cost of these and other needed investments. Consumers generally have a positive view of their utility’s work to provide reliable power and prepare for efficient restoration following a major event, so it is critical that utilities maintain and continue building that trust. One of the biggest opportunities available to utilities as they build customer trust is responding quickly and with transparency during times of crisis.

Residential customers surveyed by Chartwell have indicated their willingness to engage with and learn more from their utility about opportunities to take environmentally friendly and energy-saving actions. This support for sustainability, albeit with regional and demographic nuances, may also translate into higher tolerance for utility investments when they are clearly and transparently explained as providing greater access to renewable or green energy sources.

Finally, consumers asked in 2025 about the role(s) they want their utilities to play over the next three-to-five years most frequently said that they want their utility to do a better job of providing products, services, and tools to meet their needs. Consumers want to feel seen and have their specific needs recognized by their service providers, including utility companies. By (1) offering value-added services and (2) taking extra steps to market those products and services to customers whose needs most align with each offering, utilities are best able to offer satisfying and personalized service to customers. This is especially true for digitally inclined customers who are looking to self-serve and want an easy, low-touch interaction with their utility company.

Residential customers are highly attuned to energy-related issues and utility services that align with their priorities, especially where they can save money and achieve their goals in partnership with the utility.

Each of the five core customer expectations outlined above will be featured in upcoming Insight Center content, further detailing the findings from Chartwell’s 2025 Residential Consumer Survey.

For a detailed look at Chartwell’s 2025 Residential Consumer Survey and data supporting the highlighted customer expectations, refer to Chartwell’s Premiere Report: Customer Views of the Utility in 2025.

Methodology: Chartwell’s 2025 Residential Consumer Survey was an online survey of more than 2,000 U.S. and Canadian residential energy consumers conducted in June and July 2025. Respondents included approximately 400 consumers from each U.S. Census region and Canada. Its age, gender, income, and race distribution reflect that of the general population.

To learn more about the Chartwell CX Council, please reach out to Tim Herrick.

You may also like these blog posts:

- Celebrating Global CX Day 2025: Chartwell’s Commitment to Customer Experience

- AI-Powered Chatbot Reduces Customer Requests by 27%, Wins Chartwell Recognition

Related Insight Center research: